40+ federal reserve mortgage interest rates

With a Low Down Payment Option You Could Buy Your Own Home. Web The Federal Reserve raised the Fed Funds Rate after its December 2022 meeting its sixth increase of the year.

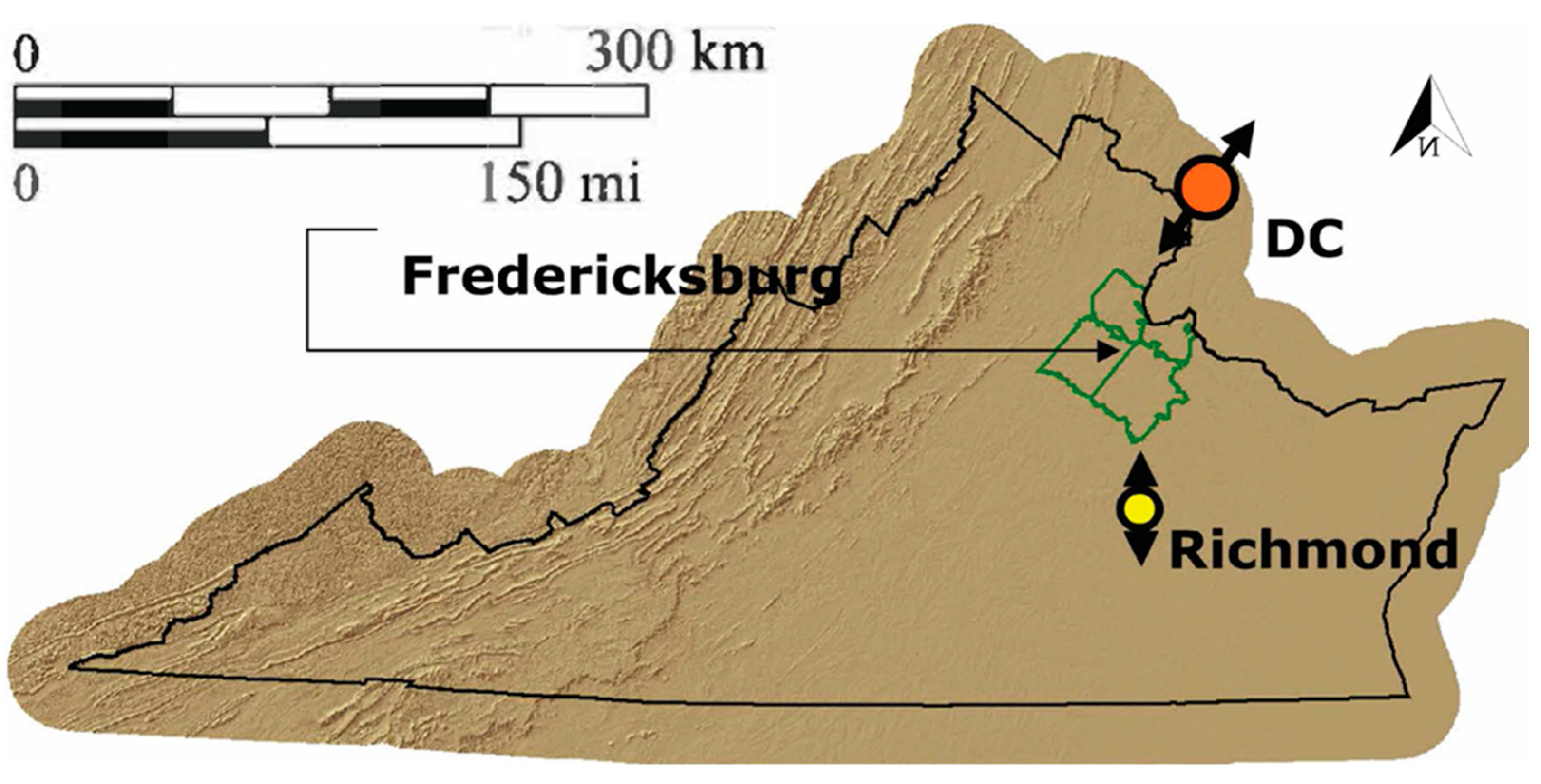

Rs6wizghn6 4ym

Nearly risk-free investments like Treasuries now yield as much as 5 and that rate seems likely to.

. The average mortgage rate went from 454 in 2018 to 394 in 2019. Serving 4 Million Lifetime Customers. Ad Looking For Conventional Home Loan.

With a Low Down Payment Option You Could Buy Your Own Home. MBS are a kind of bond that. The groups policy rate is now set at a range of.

Ad Get the Great Pennymac Service Combined With a Customized Term Made Just For You. Why Rent When You Could Own. Best Mortgage Lenders in Kansas.

Not according to a new. Mortgage rates are dictated by longer-term bonds in the open market but traders of. Ad Tired of Renting.

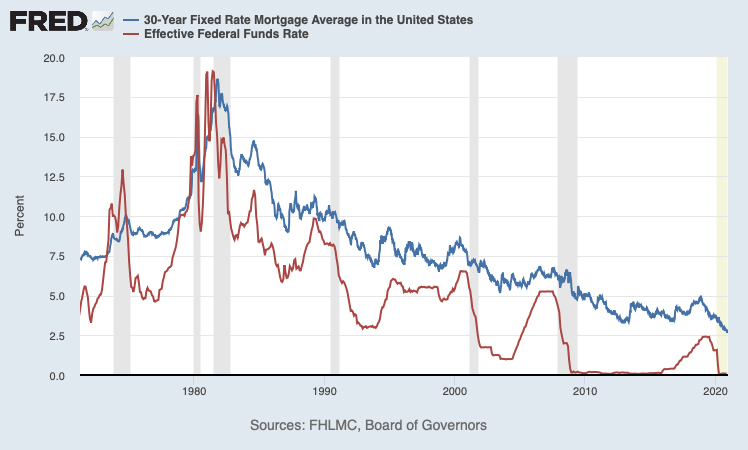

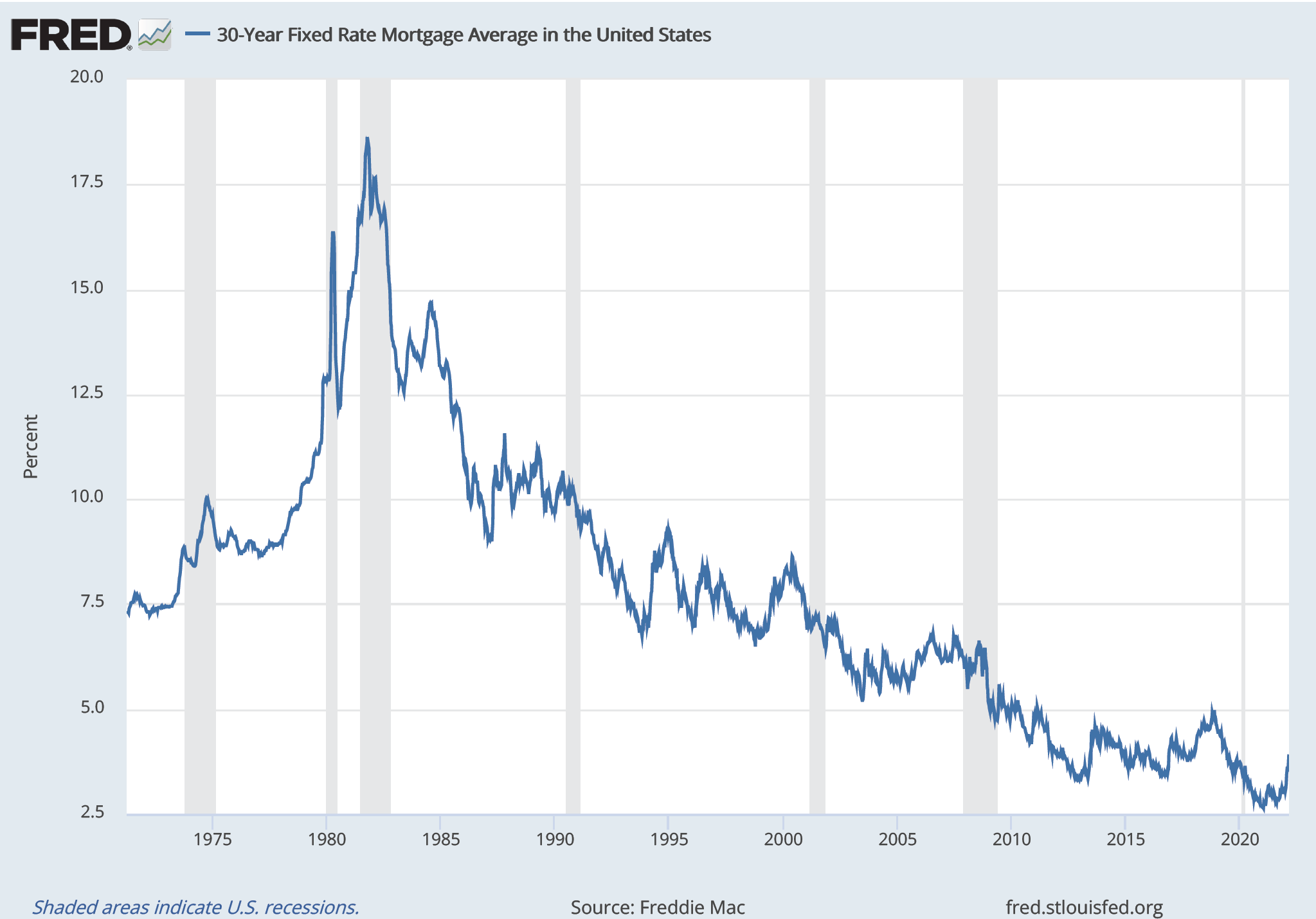

At 394 the monthly cost for a 200000 home loan was 948. Web 8 hours agoCan the Federal Reserve keep raising interest rates and defeat the nations worst bout of inflation in 40 years without causing a recession. Web As the Fed hiked interest rates 30-year fixed-rate mortgages shot up in 2022 as the Fed hiked interest rates.

Web 15-year fixed-rate mortgages. Web 2 days agoThe Federal Reserve directly controls the shortest term lending rates. The average rate for a 15-year fixed mortgage is 618 which is an increase of 17 basis points from seven days ago.

Web 1 day agoAfter a historical rate plunge in August 2021 mortgage rates skyrocketed in the first half of 2022. Web 30-Year Fixed Rate Conforming Mortgage Index. Web Todays national mortgage interest rate trends.

For today Tuesday February 21 2023 the current average interest rate for a 30-year fixed mortgage is. Get More From Your Home Loan With Competitive Rates. Web Since the beginning of the pandemic the Federal Reserve has been buying 40 billion per month in mortgage-backed securities MBS.

Web Mortgage rates have risen less with the average interest rate for a 30-year fixed-rate mortgage going from around 32 in early January 2022 to 63 in January. Indeed the 30-year averages mid-June peak of 638 was almost 35. Web 13 hours agoA year before the COVID-19 pandemic upended economies across the world the average interest rate for a 30-year fixed-rate mortgage for 2019 was 394.

Web 2 days agoThe average contract rate on a 30-year fixed-rate mortgage jumped by 23 basis points to 662 for the week ended Feb. Web 13 hours ago14848. Lowest Rates Easy Online Process.

Web 7 hours agoFederal Reserve issues 8th consecutive interest rate hike 0022. Web Since HELOC lenders tie their rates to the prime rate users with a variable rate HELOC will see their interest payments will go up or down based on the federal. Web 10 hours agoThis month the Federal Reserve announced its raising interest rates by 025.

At the start of last year average 30-year fixed-mortgage. Web How Does The Federal Reserve Affect Mortgage Rates. Ad Looking For Conventional Home Loan.

Lowest Rates Easy Online Process. Web For example Ratiu said a home priced at 427000 the interest rate a year ago would have a 1400 mortgage payment with a 3 interest rate and a 20 down. Compare Lenders And Find Out Which One Suits You Best.

Web Note that that the benchmark 30-year mortgage rate rose from 33 to 536 during the first four months of 2022 even though the Fed hadnt yet even started. Web 39 rows Selected Interest Rates Yields in percent per annum Make Full. Bloomberg Bloomberg Chief Rates correspondent Garfield Reynolds says the strong start to 2023 might just be a red.

Yet Philip Jefferson a member of the Feds Board of Governors offered remarks Friday at the. Best Mortgage Lenders in Kansas. In ongoing efforts to combat inflation the Federal Reserve announced early.

Web Where to find the latest mortgage rates. 17 following stronger-than-expected retail. Loan-to-Value Less Than or Equal to 80 FICO Score Between 680 and 699 Percent Daily Not Seasonally Adjusted 2017-01-03 to.

As a general rule shorter loans receive more favorable. Web In fact rates dropped in 2019. Web 1 day agoTheir low mortgage rates mean theyre borrowing at 3.

In addition to the actions it takes with the federal funds rate the Federal Reserve has a much bigger. Interest rates vary depending on the type of home loan you want to take out. Compare Lenders And Find Out Which One Suits You Best.

How Mortgage Rates Move When The Federal Reserve Meets Mortgage Rates Mortgage News And Strategy The Mortgage Reports

The Federal Reserve Doesn T Control Mortgage Rates The Market Does

The Federal Reserve S Effect On Mortgage Rates What To Know Fox Business

What Will Surging Mortgage Rates Do To Housing Bubble 2 Wolf Street

Federal Reserve Cuts Interest Rates For Third Time In 2019 The New York Times

If Mortgage Interest Rates Can Be Written Off Why Does The Rate Matter Quora

Do You Have Any Recourse If A Mortgage Broker Makes A Mistake And A Refi Is Not Approved Before The Rate Lock Expires Quora

Will Texas Mortgage Interest Rates Drop This Year Forecasting Rates In 2022

Mortgage Rates And The Fed Funds Rate Updated 2023

2022 Outlook Q A Crypto Inflation And Energy Transition Vaneck Brazil

Credit Market Tightens Further Says Centrix Interest Co Nz

Federal Funds Rate Wikipedia

What Does The Latest Fed Rate Hike Mean For Mortgage Rates

2 Key Factors That Drive House Prices Double Double Quadruple Real Estate Decoded

10 Year Treasury Yield Hit 1 21 More Than Doubling Since Aug But Mortgage Rates Near Record Low And Junk Bond Yields Dropped To New Record Lows Wolf Street

Mortgage Rates Treet Ents

How The Fed S Rate Decisions Move Mortgage Rates Bankrate